It's very important for HR departments to clearly connect the Total Cash benefit to staff, emphasizing the various factors that lead to their In general payment. This can be reached through:

Total Cash signifies an organization's total consolidated cash and cash equivalents, held in accounts which have been ruled by a specific settlement which officially secures the legal rights for the deposit account(s) or securities account(s) for the advantage of lenders below a bank facility. Noticed in 6 SEC filings.

Routinely solicit responses from employees to make sure that the Corporation’s recognition and benefits software is Conference their needs and expectations. This opinions might help identify spots where by non-economic rewards could possibly be additional significant or successful in motivating staff.

Generally speaking, companies that are still escalating might not have loads of traction of their respective current market still. Therefore their day after day liquidity depends on alternate cash sources (including credit card debt or enterprise capital cash).

It offers us an First sign of how leveraged the corporate is. If a business fails The online cash check (just after considering amazing instances), the corporate is looked at less positively than an organization with a positive cash situation.

As an example, a profits manager may perhaps receive a part of their profits Associates’ gross sales as being a commission payment or “override” for his or her purpose within the sales method.

Solicit employee responses on their own notion of Total Cash deals and determine areas for advancement or adjustment.

Excerpt from BC nine in ASU 2016-18 … only People monetary devices that very first meet up with the definition of cash or cash equivalents prior to thinking about the limitations that exist in the separate provision outside the house People economical instruments should be included in the … total of cash, cash equivalents, and amounts typically called limited cash or limited cash equivalents about the statement of cash flows.

Exactly what is the Cash Ratio? The cash ratio can be a measurement of a firm's liquidity. It calculates the ratio of a business's total cash and cash equivalents to its present-day liabilities. The metric evaluates a business's power to repay its quick-phrase personal debt, also to shell out The existing portion of its long lasting debt such as the principal and desire, with cash or near-cash resources for example simply marketable securities.

It is different from net cash move, that's calculated since the cash acquired by the corporate in a selected period right after spending all its operational, fiscal, and more info capital dues, together with dividends to shareholders.

A company that earns the majority of its cash from its core operations will most likely manage to maintain its liquidity for an extended timeframe.

Building performance-based bonuses that reward staff members for Assembly or exceeding their personal KPIs or contributing into the accomplishment of crew or departmental goals.

Being familiar with Cash and Cash Equivalents (CCE) Cash and cash equivalents are a group of property owned by a firm. For simplicity, the total worth of cash available features objects with the same mother nature to cash.

Firms typically keep cash and cash equivalents to pay limited-expression financial debt and hold funds in safe locations for long run use.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Christy Canyon Then & Now!

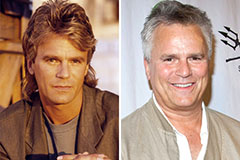

Christy Canyon Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!